Heavily Interconnected Economies Are Vulnerable to Shocks

When an economic shock occurs, countries with the most connected industries are the most likely to fail, without concerted governmental efforts, according to a new analysis. The researchers used network theory to study the spread of economic shocks from one industry to another through inter-industry trade links within each of 22 European countries. The results suggest that the danger to a national economy presented by the failure of a specific industry depends largely on the number of trade links the industry has and not exclusively on its total production.

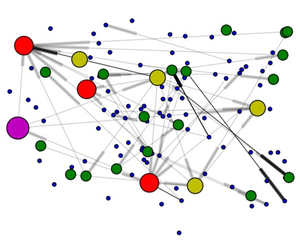

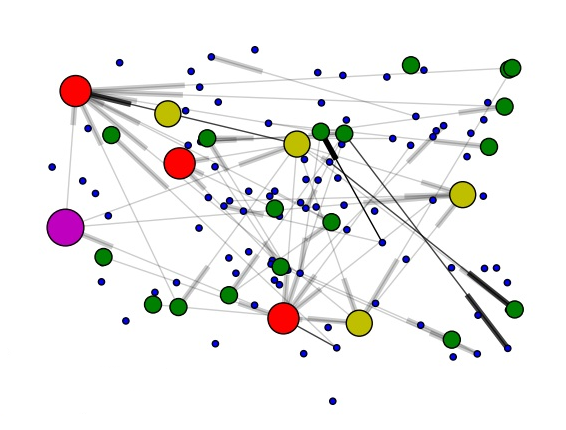

Researchers have studied networks of friends, of computers, and of train stations, by imagining a number of “nodes,” or dots, with lines connecting them. In such networks, the “hubs” are the most highly connected entities, such as Chicago in the US aviation system, and when they experience a change, it can have a huge effect on the rest of the network. In recent years, some economists have represented each sector in a national economy—such as housing, technology, or food—as a node, with connections based on inter-sector trade. In these models, each link has a “strength” based on the amount of trade between the sectors it connects. Last year, a research team looked specifically at the effects of an economic shock on a system of connected industries, but they used traditional macroeconomic techniques instead of the full network theory [1].

For a more thorough network study, economists Martha Alatriste Contreras, of the School for Advanced Studies in the Social Sciences in Marseille, France, and Giorgio Fagiolo, of the Sant’Anna School of Advanced Studies in Pisa, Italy, used publicly available data to build up a network of economic sectors for each of 22 European countries. Their data from the European Union track all of the buying and selling in the year 2005 among 59 different sectors. The researchers also used some standard equations that model the relationships between each trade link and the total production in a sector.

Alatriste Contreras and Fagiolo applied two different kinds of shocks to each country’s network. First, they created a large, sudden drop in the consumer demand in one sector and observed the effects. For example, a drop in home buying would lead to less demand for home loans in the financial sector and to a reduced demand for construction materials. These sectors would in turn reduce demand for other sectors with which they trade. The team measured the nationwide effects of shocking each sector this way. Next, they applied a sudden change in the availability of resources to a specific sector—for example, electricity was scarce after the 2011 nuclear power disaster in Japan, which reduced industrial output and thus demand for raw materials. A sudden rise in oil prices could cause a similar kind of shock.

The researchers found that the economic sectors that have the most direct and indirect trade connections—the hubs—spread the shock the farthest and have the most potential to cause a nationwide crisis. However, these sectors are not the ones that experts would expect, says Alatriste Contreras. “Economists have traditionally said that industrial sectors such as manufacturing are the most important,” based on their size. But the team found that some of the most important sectors for spreading the effects of shocks are service sectors, such as business services, construction, and the financial industry. Sectors that are more isolated, such as the uranium ore industry, do not spread shocks as far.

The researchers also found that the countries with the largest economies, such as Germany and France, are the most vulnerable to nationwide crises because their sectors are highly developed and interconnected. Alatriste Contreras says that strong governmental intervention—which is not yet included in the team’s models—probably saved these countries from collapse in the latest recession.

The next step is to include international trade, says Fagiolo. Alatriste Contreras is hopeful that such research can help policy makers pinpoint economic vulnerabilities and take steps to fix them through government expenditure, subsidies, and regulation.

Economist Alan Kirman, of the University of Aix-Marseille III in France, says this work builds on a growing body of network analysis within the banking sector [2] and applies it to many different sectors within a national economy. He says it begins to address the question of where government stimulus would be the most effective in a vulnerable economy.

This research is published in Physical Review E.

–Tamela Maciel

Tamela Maciel is a freelance science writer in Leicester, UK.

References

- D. Acemoglu A. Ozdaglar and A. Tahbaz-Salehi, “The Network Origins of Large Economic Downturns,” National Bureau of Economic Research Working Paper No. 19230 (2013)

- A. G. Haldane and R. M. May, “Systemic Risk in Banking Ecosystems,” Nature 469, 351 (2011)

More Information

Video interview with Alan Kirman and other experts on what financial regulators can learn from network theory