Financial Brownian Motion

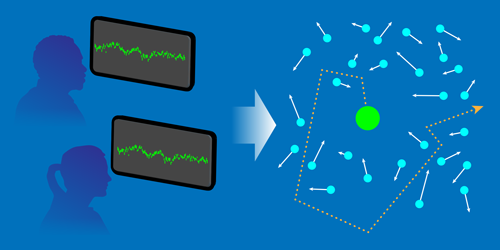

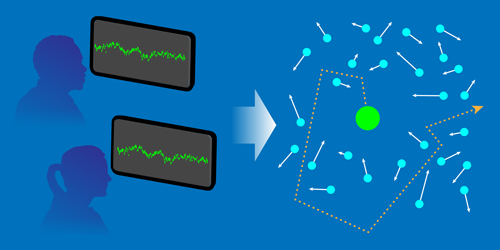

The ups and downs of financial markets seem unpredictable, but physicists have shown that stochastic random-walk models can capture large-scale market dynamics, such as changes in the Dow Jones Industrial Average. What has been lacking, however, is a model that describes the interactions on smaller, trader-level scales. Researchers have now constructed such a microscopic model using data on individual traders in a high-frequency currency exchange. The team tested the model by showing that it could be used to develop a macroscopic theory that accurately captures price distribution and other market indicators.

Stochastic behavior, like the Brownian motion of particles in a fluid, can be understood with so-called kinetic theory. In this approach, one starts with a model of microscopic interactions (or collisions) and builds that into a macroscopic framework. The end result is an equation, such as the Boltzmann or Langevin equation, that describes the evolution of particle position, temperature, or some other large-scale statistical variable. Econophysicists have tried to develop a kinetic theory for financial systems, but they’ve lacked data on the microscopic behavior of individual traders.

Kiyoshi Kanazawa, from the Tokyo Institute of Technology, and co-workers analyzed five-days-worth of high-frequency trading between dollars and yen. They tracked the behavior of traders, both in their “bids” (buying price) and “asks” (selling price). The traders submit orders every few seconds, but a transaction only occurs when one trader’s ask price matches another’s bid price. Kanazawa et al. found that traders responded to each transaction by adjusting their bid/ask prices in accordance with changes in the market transaction price. They modeled this “trend following” and showed how it led to a Boltzmann-like equation for the overall price movement. This macroscopic equation could reproduce large-scale observations of the foreign exchange market.

This research is published in Physical Review Letters.

–Michael Schirber

Michael Schirber is a Corresponding Editor for Physics based in Lyon, France.